主讲人: Sharon Osterloh, Cornell University

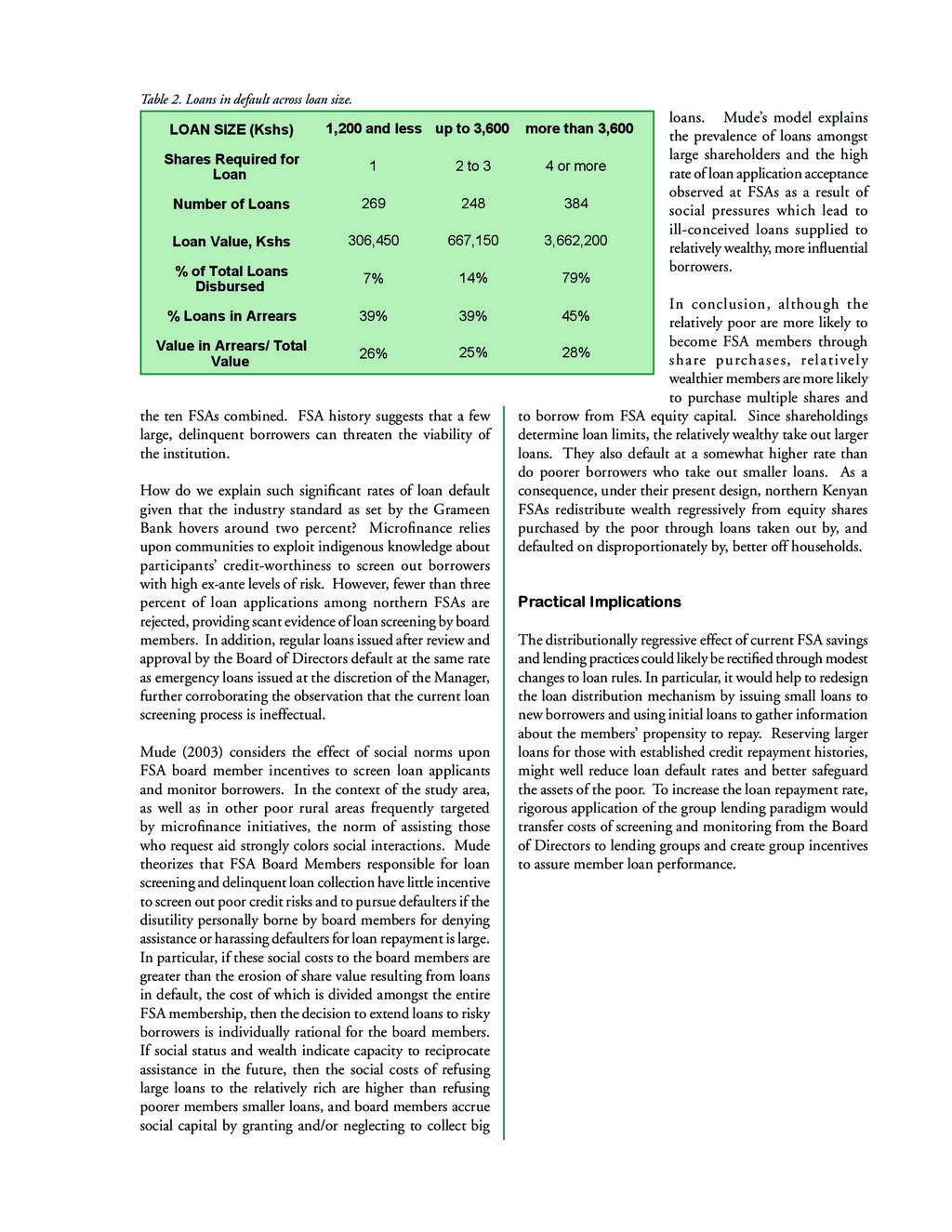

The absence of financial savings and credit access is widely cited as an obstacle to poverty reduction in the rangelands of east Africa. The well-known successes of microfinance initiatives in many parts of the world hold out the promise of scaleappropriate financial services for people traditionally excluded from financial markets, such as pastoralists in northern Kenya. Yet we find that although poorer households are indeed more likely to participate in Financial Service Associations (FSAs) operating in Marsabit District, the rules governing credit access lead to high rates of default by relatively richer borrowers, leading to problems of solvency for the financial institutions and ultimately to a regressive redistribution of wealth from poorer savers to wealthier borrowers who default on loans taken out from the FSAs. Some relatively straightforward changes in lending rules could remedy this unintended and unfortunate result.